Trade now, settle later with

Discretionary Financing!

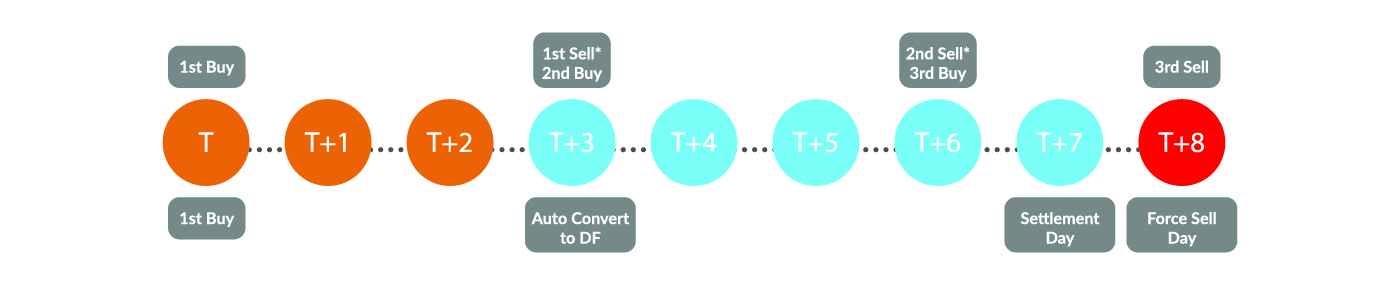

Discretionary Financing (DF) is a trading facility that allows you to buy shares and settle them any time up to T+7. This gives you significantly more flexibility compared to the Normal Trading cycle, which settles at T+2. With DF, clients will have a longer period to settle for the stocks purchased and the flexibility in terms of trading strategy and portfolio management. Fees incurred on DF are generally lower than brokerage fees incurred on multiple purchases and sales contracts.